How bonus interest rates work

Find out how bonus interest rates can affect your overall interest rate on your savings accounts.

Published:21 January 2025

What is a bonus rate?

Some providers offer savings accounts which include bonus interest rates. They are usually applied in one of two ways:

- As an introductory rate on top of the standard rate of the account.As an introductory rate on top of the standard rate of the account.

- As a conditional rate, meaning certain conditions (such as number of withdrawals, a minimum balance or saving a certain amount) must be met to receive the bonus rate.As a conditional rate, meaning certain conditions (such as number of withdrawals, a minimum balance or saving a certain amount) must be met to receive the bonus rate.

Our savings accounts don’t have conditional rates - but both our Internet Saver account and Instant Access Cash ISA include a bonus rate that is applied as an introductory offer for the first 12 months of the account. This means for the first 12 months the overall interest rate on these accounts is made up of two parts: the bonus interest rate and the standard variable rate.

What is a standard variable rate?

The standard variable rate refers to a rate that can go up or down, if it changes it will affect your overall interest rate.

The standard variable rate is the underlying rate that is always applied to our Internet Saver and Instant Access Cash ISA accounts. It will become your overall interest rate when your bonus interest rate ends.

We’ll always let you know if the standard variable rate is changing.

The illustration below shows how the bonus interest rate and standard variable rate make up your overall interest rate.

Bonus interest rate

(ends after a fixed 12 month period)

+

Standard variable interest rate

(for the duration of the account)

=

Your overall interest rate

(after 12 months, this only includes the standard variable rate)

Example of a standard variable rate

If you open your account with a bonus rate of 3.5% and the standard variable interest rate at the time is 1.5%. This would give an overall interest rate of 5%.

If after 6 months, our standard variable rate reduced from 1.5% to 0.5%, your overall interest rate would then be 4%.

What does this mean for the overall interest?

With our accounts, interest is calculated daily, so your interest is only affected from when the standard variable interest rate changes. This means in the example above, your total interest over 12 months would include the combined interest rate of 5% for the first 6 months, then 4% for the next 6 months.

If your account includes a bonus rate, you may see this interest paid at a different time - currently we pay your bonus interest at the end of the bonus period (on the anniversary of the account opening) and pay the standard variable interest annually in March.

What happens when the bonus rate ends?

After 12 months your bonus rate of interest will end and you would continue to earn the standard variable rate.

At that point you have the option of moving to another account to take advantage of a better interest rate or continuing to save in your account on the standard variable rate.

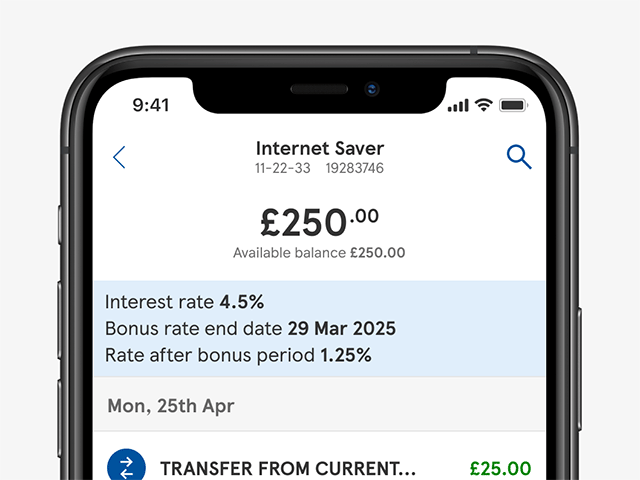

Check your rate in our Mobile App

You can see your overall interest rate and the date your bonus rate ends in our handy Mobile App. After your bonus period ends, you’ll still see your overall interest rate, but this will now only be made up of the current standard variable rate.