Our Mobile App is easy to use, super smart and totally secure.

You can manage your credit card in our app, make payments, view your statements and more. You can register in a few easy steps.

Viewing your credit card in our Mobile App

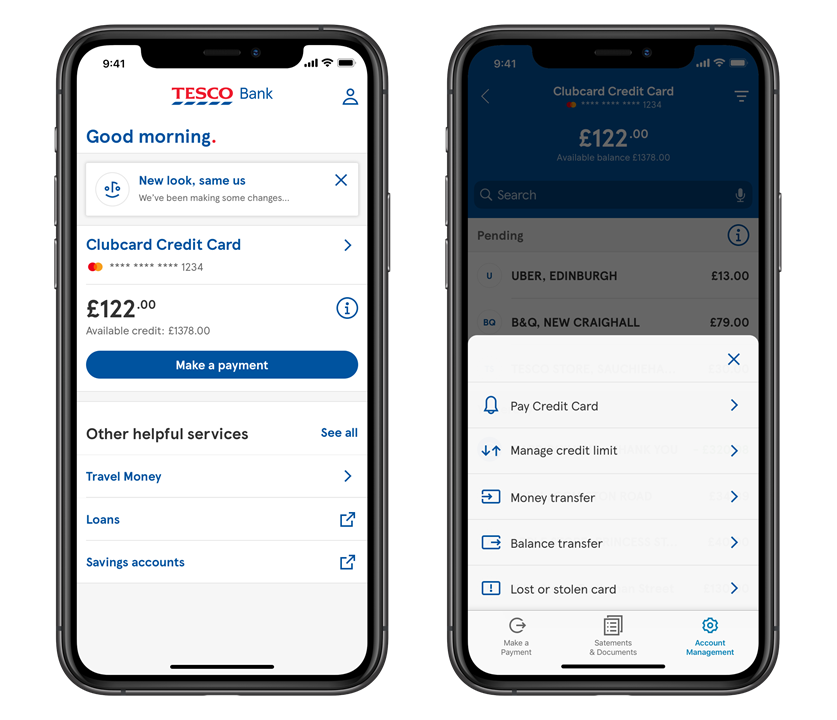

Once you’ve registered for our Mobile App, you’ll be able to view your account and manage your money on the go from the home screen.

You’ll see your account details and balance displayed. To see an account summary for your credit card, select the information icon next to your account name.

To look at your recent and pending transactions, just tap on your credit card account.

You can manage your account using the menu on the Transactions screen. You can make payments, complete balance and money transfers, view statements, manage your credit limit and more.

Have more than one account with us? You can use Online Banking to link these to show in the App with your credit card. Log in to your credit card account and find Add your other Tesco Bank accounts at the bottom of the page. Enter the sort code and account number of your savings, loan or current account and you’re all set.

Paying your credit card

You have three ways to pay your credit card bill in our Mobile App.

Make a one-off payment using a debit card, pay direct from a bank account or set up a Direct Debit to know your payments are covered each month. Give us the account number and sort code of your chosen bank account, choose your payment amount and rest easy.

For more information about Pay by Bank please visit our dedicated pages here.

Transactions

View Transactions to see all your recent payments in and out. You can search and sort through them to find something specific with the buttons at the top of the screen.

We even show pending transactions for your credit card so you’re up to speed 24/7.

Statements

You can see all your statements and documents in our Mobile App. Select your credit card from the Home screen, then from the menu at the bottom of your Transactions screen choose Statements and Documents.

If you need to export a statement you can select the Share button (top right of the screen) as you view it. This shows you all the available sharing options for your device, including saving as a PDF or sending via email. Ways to share will vary depending on the software you have on your phone.

To turn off paper statements and instead only receive digital copies you can go to Settings, scroll to More and select Paperless to change the paper settings for your account.

Lost or stolen Credit Card

Lost your credit card? We can put a temporary block on your account before cancelling your card completely. So, if your card turns up again you can simply unblock your account and carry on using it. Simple as that.

Whilst your card is blocked, your account will still be active, but all transactions and additional cardholders will be on hold. If you don’t find your card, or think it might have been stolen, you can easily cancel and order a new card right there in the App.

Open the menu at the bottom of your credit card home screen, and you’ll find the Lost or stolen card option.

Balance transfers and money transfers

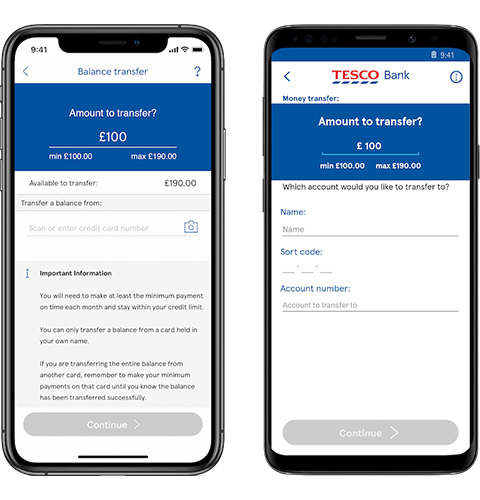

You can make balance transfers and money transfers straight from our Mobile App.

On the Account management menu at the bottom of your credit card transactions screen, you’ll find balance transfers and money transfers. To make a transfer just tell us the amount and where you want the money to go. Confirm with your usual log in details, and that’s it.

Managing your credit limit

Want to change your credit limit? Either decreasing or increasing your credit limit is simple in our app, and it just takes seconds.

You can decrease your credit limit at any time. To increase your limit, we have an approval step – any increase will depend on your personal circumstances. Before you start just be aware that you’re unlikely to be approved for an increase if:

- You’ve changed your credit limit within the last ten months (increase or decrease).You’ve changed your credit limit within the last ten months (increase or decrease).

- You’ve had your credit card for less than six months.You’ve had your credit card for less than six months.

- You’re already at the maximum credit limit we can give you.You’re already at the maximum credit limit we can give you.

- Your balance is over your current credit limit.Your balance is over your current credit limit.

- There are outstanding payments to be made to your credit card.There are outstanding payments to be made to your credit card.

In requesting a credit limit increase you are authorising us to review your credit history and any other relevant information required to process your request. Your request won’t impact your credit score. Please carefully consider if you need a higher limit as it may increase the risk of taking on too much debt, which may be costly or take a long time to pay off.

To change your credit limit select Manage credit limit from the menu at the bottom of your credit card home screen.

If you have more than one credit card with us, we can’t change your credit limit in our app, but we can do this for you in Online Banking or over the phone.

Other customers have been asking:

Need help with our Mobile App?

If you'd rather talk to us, get in touch. Call our UK-based customer service team on 0345 300 3511*. Our technical helpdesk lines are open 8am to 10pm, seven days a week.

If you have difficulties with your hearing or speech, contact us through the Relay UK app. You can find out how to use Relay UK on their website.

*This number is designated as a UK landline by mobile phone operators.